Rating Agencies and Burnt Pizza

In recent headlines, Fitch Ratings downgraded its US debt rating from the highest AAA rating to AA+, citing "fiscal deterioration over the next three years and a high and growing general government debt burden."

Key Takeaways

We believe that holding treasuries among other assets in a portfolio is a fine way to diversify investments.

US treasuries can earn between 4 and 5.5%, depending on maturity.

A default by the US government is unlikely and would be unprecedented.

Worth noting, Moody's rating agency also just recently downgraded several banks. Moody's warned that a worsening in bank asset quality is on the horizon.

Let's unpack the headlines. What it is and what it could mean. Who is Fitch?

In the US, there are three main credit rating agencies known unoriginally as the Big Three. They are S&P Global Ratings, Moody's, and Fitch. The Big Three hold a collective global market share of "roughly 95 percent," with Moody's and S&P having approximately 40% each and Fitch around 15%. Fitch Ratings is owned by Hearst Communications. Hearst also owns newspapers, magazines, and TV channels.

Credit rating agencies provide letter grades on bonds issued by governments, municipalities, and corporations.

Why are the Big 3 important? Because the government said so. In 1975 the SEC granted the rating agencies the special designation of "Nationally Recognized Statistical Rating Organizations (or NRSRO for short)."

Credit ratings are assigned on an alphabetic scale from 'AAA' to 'D.' With an intermediate plus and minus used between categories.

AAA is the best. Said to be reliable and stable.

D is the lowest rating, has defaulted on obligations, and is expected to default again.

Ratings below BBB are often considered "non-investment grade" or junk. This doesn't mean you can't invest in them, just that they carry more risk.

Currently, the US is listed as AA+ or better.

Fitch Ratings:

Fitch cites expected fiscal deterioration over the next three years, a high and growing general debt burden, combined with the last two decades that has manifested in repeated debt limit standoffs and last-minute resolutions in their recent downgrade announcement.

What does the chairman of the US Budget Committee say about this:

"With annual deficits projected to double and interest costs expected to triple in just ten years, our nation's financial health is rapidly deteriorating, and our debt trajectory is completely unsustainable."

And, what does US Treasury Dept say?

Treasury Secretary Janet Yellen called Fitch's downgrade "surprising" considering the nation's strong economic recovery from the Covid pandemic.

Yellen touted recent robust US economic numbers and said, "Treasury securities remain the world's preeminent safe and liquid asset."

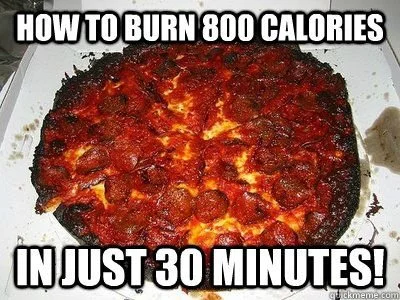

Let's compare rating agencies to cooking!

Sometimes your cooking may produce smoke, which activates the smoke alarm. In some cases, full-on smoke isn't even present — a hint of burnt food can be enough to set off the detector. The smoke alarm by itself doesn't tell you if the pizza is a little burnt or if there is a fire in the house. Nor does it tell us what will happen next.

In the days after Fitch's announcement, the price of insuring against US default barely moved when looking at Credit Default Swaps. Put another way, the smoke detector went off, but the homeowner insurance premiums didn't change. Why not?

We believe asset prices reflect all available information in the market. It is no surprise that the US has over $32 trillion in debt and has been operating in a deficit for years; this year is expected to be a $1.4 trillion deficit. Markets are forward-looking, and the concerns that played into Fitch's downgrade decision are not new information to most market participants. Rating agencies have access to the same historical data and observations that other market participants have.

If the market has priced in the unlikely possibility of a treasury default is the answer, what is the question? For those in or near retirement, perhaps the question is, how can I protect my purchasing power and grow my wealth? Can I trust the IOU from Uncle Sam?

At Vector, we believe that investing in a variety of asset types, including treasuries, to match portfolio expectations with life's goals is the right approach. Limiting the concentration of any one asset type is prudent.